san francisco payroll tax withholding

San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. Behind the scenes our software handles all the hard work - collecting time and attendance data accounting pre-tax benefits withholding 7000 kinds of taxes paying each employee paying federalstatelocal tax agencies and filing tax returns.

Payroll Tax Vs Income Tax What S The Difference The Blueprint

Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

. Treasury and IRS issue final regulations on the deduction for qualified transportation fringe and commuting expenses. Elizabeth McGee is a California tax attorney who focuses her practice on tax disputes with the Internal Revenue Service. Ensuring the tax withholding platform is performant available 24x7x365 resilient and stable.

She advises clients seeking audit reconsideration and with tax appeals. Maintaining and improving our monitoring alerting self-healing release management processes. Our Online Payroll Management System includes the following modules.

The city of san francisco levies a 150 gross receipts tax on the payroll expenses of large businesses. Strong knowledge of Federal and State payroll regulations including tax withholding garnishments overtime pay shift differentials and lead pay. Utah State Tax Withholding Update - No change.

CA - San Francisco. The payroll taxes for the city of San Francisco in the state of California are Federal Unemployment Insurance Tax 2021 Social Security Payroll Tax Employer Portion Medicare Withholding 2021 Employer Portion California Employment Training Tax California Unemployment Insurance Tax San Francisco Payroll Expense Tax. The San Francisco local income tax is imposed on.

Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents. The payroll taxes for the city of San Francisco in the state of California are Federal Unemployment Insurance Tax 2021 Social Security Payroll Tax Employer Portion Medicare Withholding 2021 Employer Portion California Employment Training Tax California Unemployment Insurance Tax San Francisco Payroll Expense Tax. San Francisco Tax Attorney.

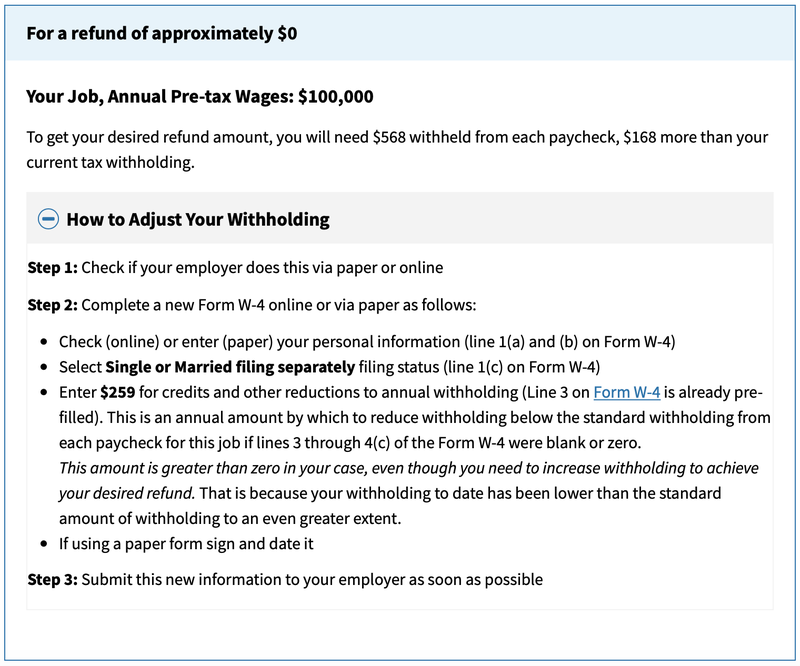

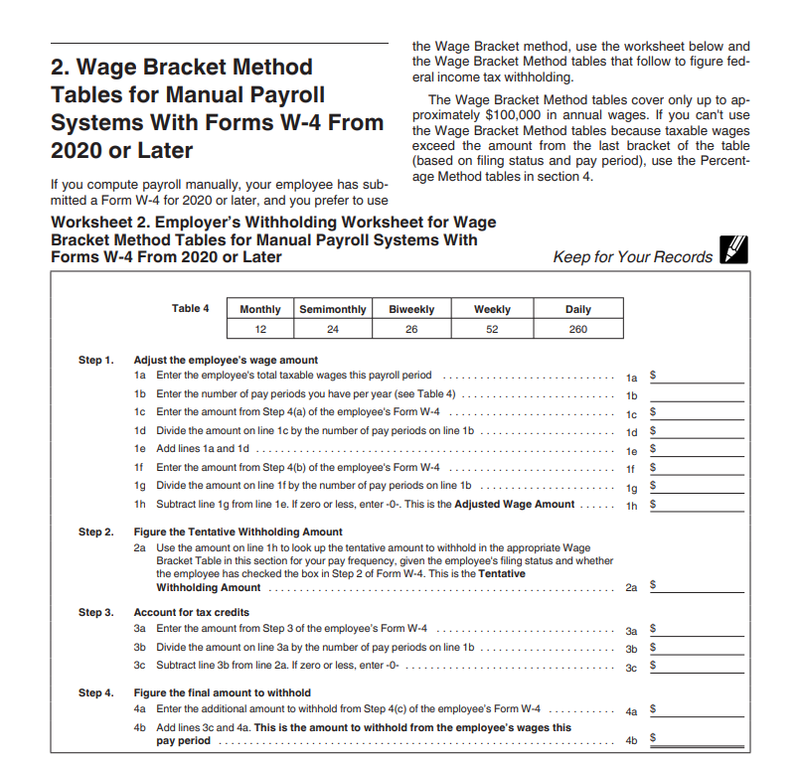

You should ask employees to fill out a new W-4 form each year if they want to change their allowances. Your employer matches the 62 Social Security tax and the 145 Medicare tax in order to make up the full FICA taxes requirements. The full-service product simplifies each payroll cycles effort from daysweeks of data gatheringcrunching to just one click.

On the W-4 form employees tell you how many allowances they are claiming for tax purposes. Monthly withholding tax report to Tax Bureau. Strong knowledge of Union payroll.

Knowledge of international payroll fundamentals preferred. The payroll taxes for the city of San Francisco in the state of California are Federal Unemployment Insurance Tax 2021 Social Security Payroll Tax Employer Portion Medicare Withholding 2021 Employer Portion California Employment Training Tax California Unemployment Insurance Tax San Francisco Payroll Expense Tax. Online Basic Data collection.

Andor temporarily halting garnishment orders. New Jersey state tax withholding. Every employee must provide their employer with a signed W-4 withholding exemption form so that you can withhold the correct amount from their paychecks.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. She represents clients in audits guiding her clients through the irs. San Francisco California - Payroll Expense Tax PY Link.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

Although most states have their own versions of a quarterly tax reporting system Accuchex will prepare and submit your quarterly payroll taxes according to the individual requirements of the appropriate state. Apply to Caregiver Payroll Manager Regional Manager and more. Comfortable in a fast paced company.

Teleworker nexus and income tax withholding 157 Missouri. Federal legislation under the Families First Coronavirus Response Act FFCRA. Lindi business services is a full service tax accounting and business consulting firm located in san francisco ca.

San Francisco Income Tax Information. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. San francisco payroll tax withholding.

If you earn over 200000 youll also pay a 09 Medicare surtax. San francisco payroll tax withholding. Unless two states have a reciprocity agreement which allow residents to pay tax only based on where they live and not where they work an employee may be required to file multiple returns to ensure proper taxation.

Ensure appropriate tax withholding accounting and compliance. Look no further for a provider of quarterly payroll taxes in San Francisco as well as quarterly payroll taxes in California. The tax rate for 2019 is 09 and youll need to withhold this tax from employees earning more than 200000 per year.

If you make 55000 a year living in the region of california usa you will be taxed 12070. Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing. She represents clients in audits guiding her clients through the IRS audit process.

London san francisco miami remote. General payrollbookkeeping duties. Employers should verify whether any similar waiver is in place for the home state of its employees when determining state income tax withholding.

Extensions on the due date of payroll tax returns tax payments or both. The passage of Proposition F fully repeals the Citys Payroll Expense Tax which has existed in one form or another since 1970 effective in 2021. Certified Management Accountant Cpa Maryland Bethesda Accountant Accounting Professional Accounting Accounting Jobs Until 2018 all businesses.

The tax is calculated as a percentage of total payroll expense based on the tax rate for the year. The tax is calculated as a percentage of total payroll expense based on the tax. Severance pay application Company Registration of San Francisco WFOE Wholly Foreign Owned Entity Work Permit application in San Francisco Working Visa Application in San Francisco.

2022 Federal State Payroll Tax Rates For Employers

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

California Payroll Tax What Employers Need To Know Workest

What Is Payroll The Complete Guide To Small Business Payroll Wave Blog

Payroll Compliance And Tax Filing Services Rippling

Payroll Tax Vs Income Tax What S The Difference The Blueprint

What Are Employee And Employer Payroll Taxes Ask Gusto

Payroll Tax In Philippines Ins Global

How To Calculate Payroll Taxes For Your Small Business The Blueprint

How To Calculate Payroll Taxes For Your Small Business The Blueprint

2022 Federal State Payroll Tax Rates For Employers

Different Types Of Payroll Deductions Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

California Payroll Taxes Everything You Need To Know Brotman Law

Payroll And Tax Compliance For Employers Aps Payroll

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Executive Summary Sample For Proposal Inspirational Executive Summary Proposal Example Pics E Executive Summary Template Executive Summary Proposal Templates